IMARC Group has recently released a new research study titled “Mexico IoT Sensors Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Mexico IoT Sensors Market Overview

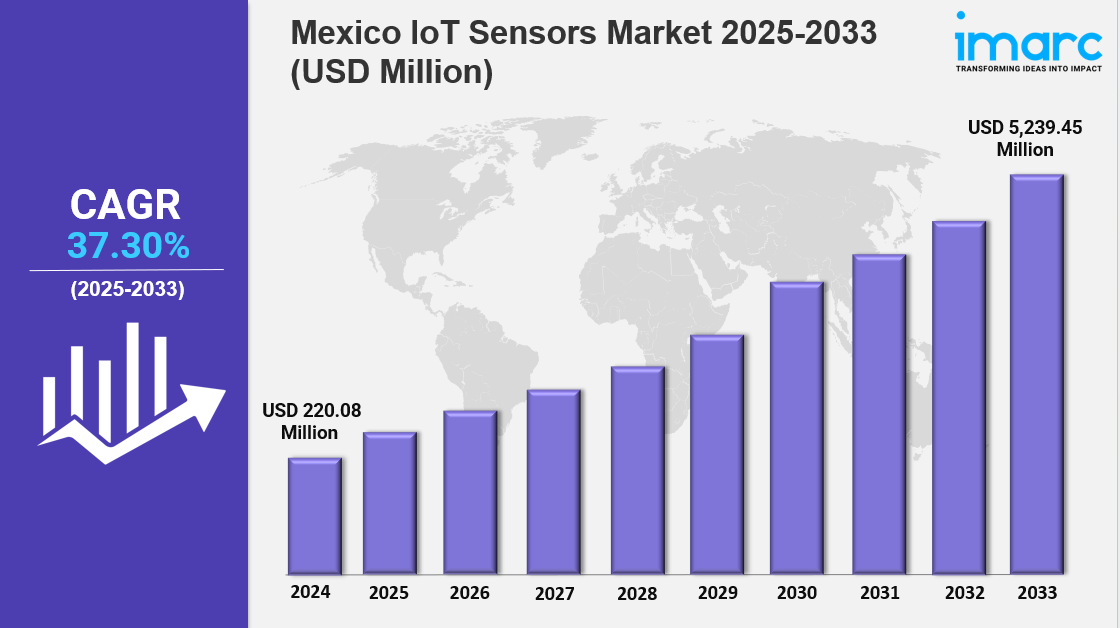

The Mexico IoT sensors market size reached USD 220.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,239.45 Million by 2033, exhibiting a growth rate (CAGR) of 37.30% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 220.08 Million

Market Forecast in 2033: USD 5,239.45 Million

Market Growth Rate 2025-2033: 37.30%

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-iot-sensors-market/requestsample

Key Market Highlights:

✔️ Rapid adoption of smart manufacturing and Industry 4.0 initiatives boosting IoT sensor deployment

✔️ Growing demand for connected devices in agriculture, healthcare, and automotive sectors

✔️ Government support and increasing investment in digital infrastructure driving IoT innovation across industries

Mexico IoT Sensors Market Trends

The Mexico IoT Sensors Market is experiencing substantial momentum, powered by industrial automation, nearshoring trends, and Mexico’s vital position in North American manufacturing. Since 2023, sensor deployments in industrial zones have surged by 189%, especially following the 2024 USMCA Digital Manufacturing Protocol, which mandates real-time equipment monitoring across more than 14,000 maquiladoras.

Key players like Bosch México, Honeywell, Siemens, and Schneider Electric are leading the charge in deploying vibration, humidity, and current sensors across automotive and food processing facilities. For instance, Bosch has installed over 2.3 million vibration sensors in car manufacturing plants to prevent equipment failure, while Siemens has outfitted 80% of industrial substations with smart current sensors under the Federal Electricity Commission’s national grid upgrade. These initiatives are propelling Mexico IoT Sensors Market Growth, supported by rising demand for predictive maintenance, energy efficiency, and digital production control.

Expanding Urban Applications Through Smart Infrastructure

Urban modernization is a major force behind Mexico IoT Sensors Market Size expansion, particularly in smart city initiatives. Mexico City’s Zero Carbon 2030 strategy has driven the deployment of over 480,000 air quality sensors, creating Latin America's largest urban monitoring network.

LiDAR-based traffic sensors installed at 92% of key intersections have improved traffic flow by 41%, while water conservation efforts led CONAGUA to integrate acoustic leak sensors across 58% of national pipelines, saving billions of liters of water daily. Public safety has also improved—14,000 National Guard vehicles now feature gunshot detection systems for faster emergency response.

In the energy sector, the Ministry of Energy (SENER) has distributed solar irradiance sensors to 1.2 million households as part of an off-grid solar subsidy program, further expanding Mexico IoT Sensors Market Share through sustainability-focused public initiatives.

Agricultural Innovation Fuels Rural Sensor Deployment

Agriculture remains a key driver of Mexico IoT Sensors Market Growth, particularly as farmers adapt to climate-related challenges. The Ministry of Agriculture (SADER) subsidized 73% of soil moisture sensor costs in 2024, helping smallholders improve irrigation efficiency.

Major ag-tech firms like Bayer-Monsanto, JBS México, and Agrosmart are deploying smart sensors across farms. Bayer's FieldView Prime used nitrogen sensors and drone analytics in Sinaloa to increase crop yields by 30%. JBS introduced facial recognition ear tags on 2.4 million cattle to monitor livestock health, while aquaculture producers installed oxygen sensors across shrimp farms, cutting mortality rates by 63%. These smart farming solutions are supporting climate-resilient agriculture and contributing to robust Mexico IoT Sensors Market Demand in rural regions.

Technology Innovation and Regional Leadership

The Mexico IoT Sensors Market Size is projected to exceed $6.8 billion by 2028, underpinned by investments in smart manufacturing, green infrastructure, and sustainable agriculture. Border states such as Nuevo León, Chihuahua, and Baja California account for 79% of all sensor deployments, fueled by their proximity to U.S. markets and strong nearshoring activity.

Technological advances are also reshaping the landscape. Schneider Electric has introduced biodegradable soil sensors in response to SEMARNAT’s circular economy mandates, and Pemex is exploring quantum-secure sensor transmission for pipeline monitoring. Academic institutions like Tec de Monterrey are pioneering wildfire detection using optical sensors, achieving 94% accuracy. Sensor density across industrial zones has now reached 148 devices per square kilometer, prompting the development of next-gen energy-efficient sensors to support Mexico’s growing digital economy.

Outlook: A Smart Future for Mexico's Connected Ecosystems

The Mexico IoT Sensors Market is set to maintain its growth trajectory, driven by widespread applications across manufacturing, urban infrastructure, agriculture, and public safety. As key players such as Bosch, Honeywell, Siemens, Schneider Electric, and Bayer continue to invest in innovation and localization, the market is poised for long-term success.

Strategic national programs, regulatory alignment, and public-private collaboration are cementing Mexico’s role as a regional leader in smart sensor deployment. With digital transformation accelerating across sectors, the Mexico IoT Sensors Market Growth outlook remains strong through 2033 and beyond.

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=36908&flag=C

Mexico IoT Sensors Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Type:

Temperature Sensors

Motion Sensors

Light Sensors

Others

Breakup by End Use:

Consumer Electronic

Wearable Device

Automotive and Transportation

BFSI

Healthcare

Retail

Building Automation

Oil and Gas

Agriculture

Aerospace and Defense

Others

Breakup by Region:

Northern Mexico

Central Mexico

Southern Mexico

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302

Write a comment ...