Market Overview 2025-2033

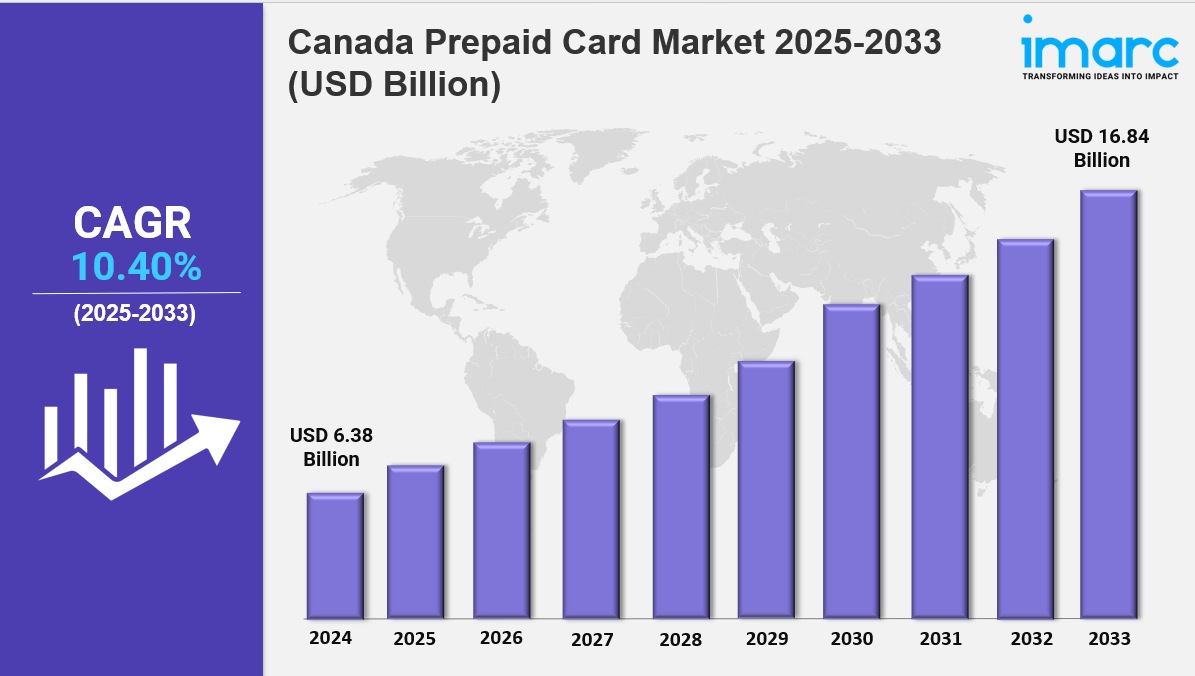

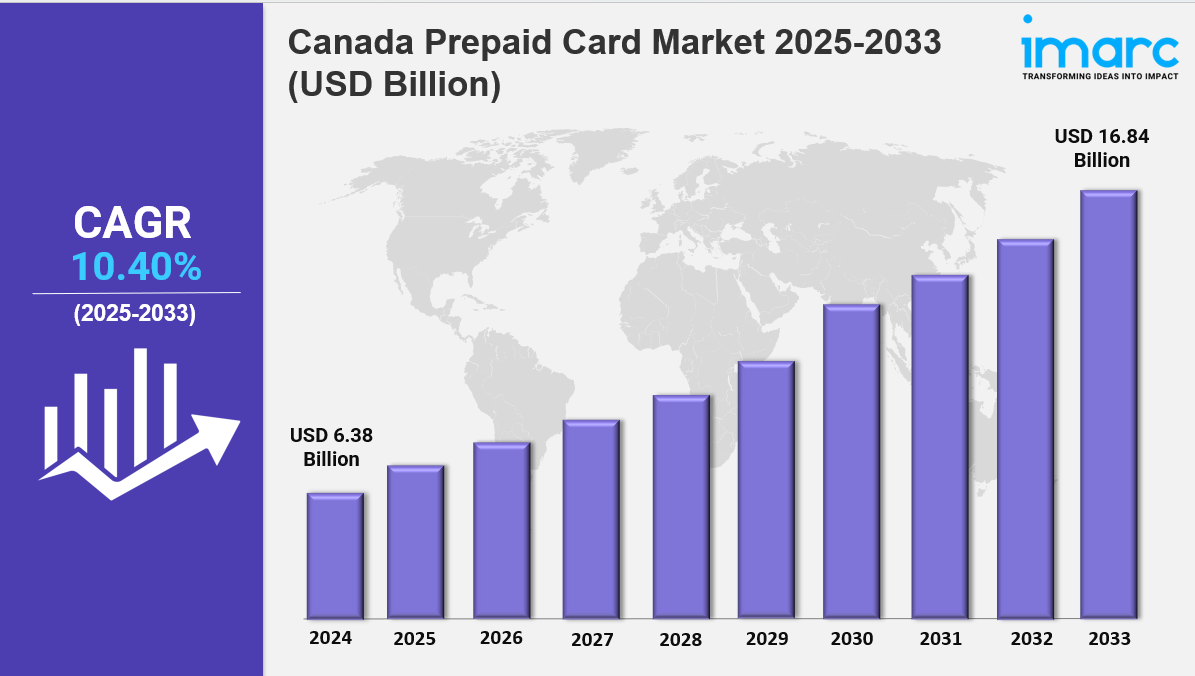

The Canada prepaid card market size reached USD 6.38 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.84 Billion by 2033, exhibiting a growth rate (CAGR) of 10.40% during 2025-2033. The market is undergoing significant expansion, fueled by the rising popularity of cashless transactions, increased consumer convenience, and the growing adoption of digital payment solutions. Key trends include a heightened demand for reloadable and gift prepaid cards, with major players prioritizing enhanced security features and user-friendly technology..

Key Market Highlights:

✔️ Significant growth driven by the increasing shift towards cashless payment methods

✔️ Rising popularity of reloadable and gift prepaid cards among consumers

✔️ Enhanced focus on security features and integration with loyalty programs

Request for a sample copy of the report: https://www.imarcgroup.com/canada-prepaid-card-market/requestsample

Canada Prepaid Card Market Trends and Drivers:

One of the main reasons the Canada prepaid card market is expanding steadily is the growing shift away from cash and toward digital payments. More Canadians—especially younger adults—are choosing prepaid cards for everyday spending, whether they’re buying groceries, shopping online, or covering monthly expenses. The appeal is simple: prepaid cards are easy to use, flexible, and help people stay on top of their budgets. This level of control is something a lot of consumers appreciate, and it's one of the key reasons why prepaid cards are gaining ground across the country.

By 2025, this shift is expected to drive even more Canada prepaid card market growth. What was once considered a niche product is now seen as a practical payment solution. Retailers and service providers are taking note, making prepaid cards more widely available to meet rising demand from consumers who want alternatives to credit or debit cards.

Reloadable prepaid cards are also playing a big role in the market’s momentum. These cards let users add money whenever they need to, without the worry of going into debt. They're especially useful for people who prefer to manage their spending closely—students, gig workers, and anyone looking to avoid overspending. As banks and retailers partner to offer more of these cards in more places, they’re becoming a common part of everyday financial life in Canada.

Technology is helping too. Many prepaid cards now come with user-friendly mobile apps that let people check balances, reload funds, and track expenses from their phones. These tools add real convenience and help make prepaid cards more appealing to a wide range of users, from teens to retirees.

According to the latest Canada prepaid card market report, innovation continues to push the market forward. Companies are rolling out new card types tailored for specific uses—such as prepaid cards for travel, gifting, or even managing employee expenses. This kind of variety makes it easier for people to find a card that fits their needs and encourages them to keep using prepaid options.

Businesses are also embracing prepaid cards as a smarter way to manage payments for staff rewards, bonuses, or customer loyalty programs. It’s a straightforward solution that avoids the complications of traditional methods like checks or direct deposits. As more companies adopt this approach, it’s adding another layer of demand to the market.

All of these trends point to a clear conclusion: the Canada prepaid card market is becoming more versatile and accessible. With stronger products, better tech, and increasing awareness among both consumers and businesses, prepaid cards are no longer just convenient—they’re becoming a normal part of how Canadians handle their money. That’s what’s driving long-term growth in this space and shaping what the future looks like for prepaid payment solutions in Canada.

Canada Prepaid Card Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Card Type:

Closed Loop Cards

Open Loop Cards

Breakup by Purpose:

Payroll/Incentive Cards

Travel Cards

General Purpose Reloadable (GPR) Cards

Remittance Cards

Others

Breakup by Vertical:

Corporate/Organization

Retail

Government

Others

Breakup by Region:

Ontario

Quebec

Alberta

British Columbia

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Write a comment ...