Market Overview 2025-2033

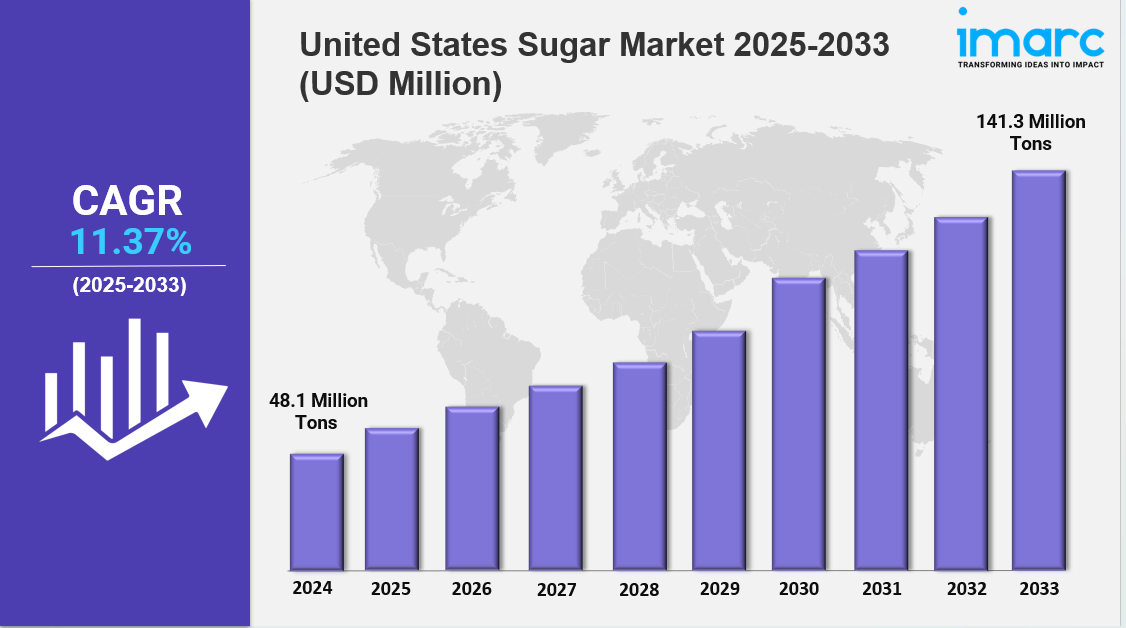

United States sugar market size reached 48.1 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 141.3 Million Tons by 2033, exhibiting a growth rate (CAGR) of 11.37% during 2025-2033. The U.S. market is expanding due to rising demand for convenient sweeteners, robust food and beverage production, and growth in industrial applications. Growth is driven by flavored and brown sugar trends, health-conscious product lines, and strong processing infrastructure, making it dynamic and competitive.

Key Market Highlights:

✔️ Steady market growth driven by sustained demand from food and beverage manufacturing sectors

✔️ Increasing focus on alternative and low-calorie sweeteners amid rising health awareness

✔️ Expanding domestic production supported by technological advancements in sugar processing and crop yields

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-sugar-market/requestsample

United States Sugar Market Trends and Drivers:

The United States Sugar Market is undergoing significant transformation, fueled by shifting consumer behavior and growing health consciousness. As rates of obesity and diabetes climb, demand for reduced-sugar and reformulated products is rising sharply. Leading food and beverage manufacturers, including PepsiCo and Coca-Cola, have expanded their zero-sugar product lines by over 40% in recent years. Regulatory efforts, such as the FDA’s labeling requirements for added sugars and the implementation of local soda taxes, are further pressuring traditional sugar usage. As a result, alternative sweeteners like stevia and monk fruit now claim an 18% United States Sugar Market Share, signaling a change in consumer taste preferences. While the pandemic temporarily drove up household sugar consumption due to a baking boom, the overall trend remains toward moderation and substitution.

Amid this changing landscape, the United States Sugar Market Size is increasingly influenced by international trade dynamics. The tariff-rate quota (TRQ) system keeps domestic prices significantly above global levels to support U.S. sugar growers. Trade tensions, especially with key partners like Mexico, have led to supply restrictions, including 2020 suspension agreements that capped sugar exports to the U.S. Meanwhile, global disruptions—from Brazil's shift toward sugarcane ethanol to climate-related events like Louisiana hurricanes—have constrained international supply, further tightening domestic availability. These pressures complicate pricing and sourcing for food manufacturers, who are advocating for TRQ reform to reduce costs in an inflationary environment.

Environmental and labor issues are also reshaping the United States Sugar Market. ESG mandates are increasingly central to procurement policies, driving investment in sustainable agriculture and ethical labor practices. Companies like Florida Crystals are leading the way, dedicating over 30% of their land to regenerative farming and reducing carbon emissions by 120,000 tons annually. Beet sugar producers face heightened scrutiny over water usage and pesticide runoff, accelerating the adoption of precision farming technologies. At the same time, labor audits have uncovered widespread wage violations, prompting a shift toward Fair Trade and other certifications now representing 18% of retail market share. As major retailers enforce stricter sourcing standards, producers are incentivized to adapt or consolidate.

Structural consolidation is a defining characteristic of the United States Sugar Market. The top five cooperatives now control over 63% of beet processing and 70% of cane refining capacity, driven by over $2 billion in automation investments since 2020. Contract farming has become the norm, providing volume stability but limiting opportunities for independent growers. On the consumption side, industrial users—including beverage and confectionery manufacturers—account for 68% of demand, though annual growth is slowing to just 0.8% as reformulation continues. In contrast, niche markets like organic and non-GMO sugars are expanding rapidly, with a projected CAGR of 7.2%, reflecting the rising influence of artisanal food and health-driven diets.

Policy remains a critical factor in shaping the United States Sugar Market Size and dynamics. Farm Bill debates have spotlighted the costs of federal sugar programs—estimated at $3.5 billion annually—while ethanol blending incentives are redirecting sugarcane output toward biofuels. Technological innovations, such as blockchain-based supply chain traceability, are being adopted across 40% of major U.S. mills to meet ESG reporting demands. Meanwhile, extreme weather events, like the 2024 Panama Canal drought, have disrupted raw sugar imports and driven up spot prices by over 20%. In response, gene-edited, drought-resistant beet varieties are now entering commercial trials to future-proof domestic production.

Looking forward, the United States Sugar Market must balance three competing priorities: health-conscious consumer demand, environmental sustainability, and economic protectionism. Achieving this balance will require greater collaboration among stakeholders across the value chain, from farm to retail shelf. As the industry evolves, those able to innovate and adapt will be best positioned to grow their United States Sugar Market Share in an increasingly complex and competitive environment.

United States Sugar Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

White Sugar

Brown Sugar

Liquid Sugar

Breakup by Form:

Granulated Sugar

Powdered Sugar

Syrup Sugar

Breakup by Source:

Sugarcane

Sugar Beet

Breakup by End User:

Food and Beverages

Pharma and Personal Care

Household

Breakup by Region:

Northeast

Midwest

South

West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Write a comment ...