Market Overview 2025-2033

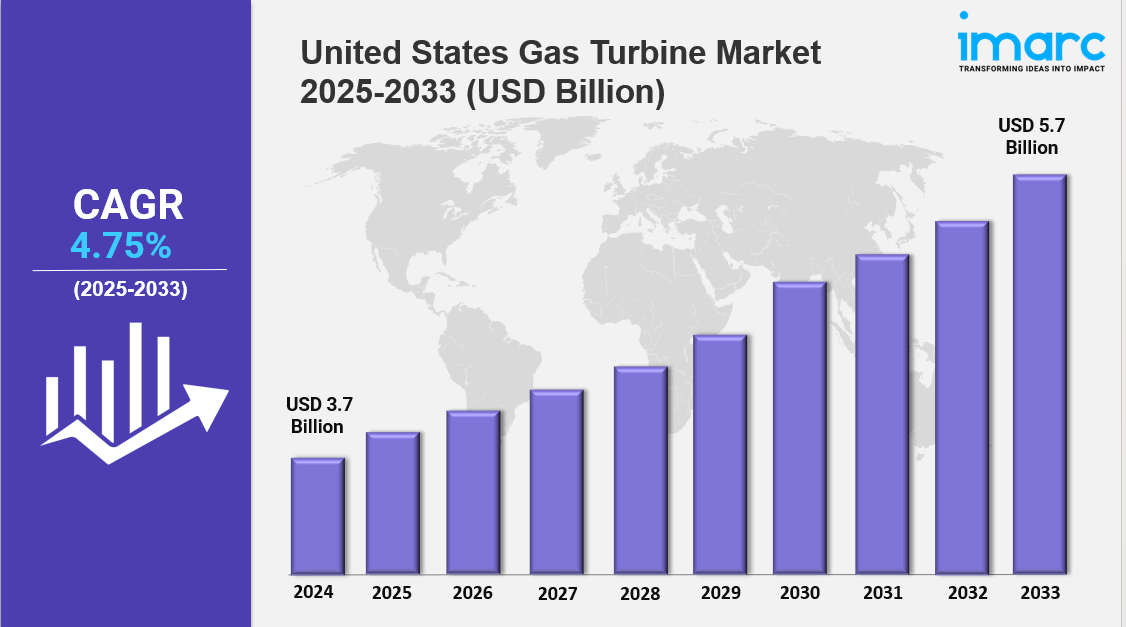

United States gas turbine market size reached USD 3.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.75% during 2025-2033. The market is expanding due to growing demand for reliable power, driven by rising data‑center loads and grid modernization. Growth is fueled by technological innovation, dual‑fuel and hydrogen-ready turbines, and policy support, making the sector more efficient, flexible, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising electricity demand and transition toward cleaner energy sources

✔️ Increasing adoption of gas turbines in combined-cycle and peaking power plants for efficiency and flexibility

✔️ Expanding upgrades and replacement of aging power infrastructure with advanced, low-emission turbine technologies

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-gas-turbine-market/requestsample

United States Gas Turbine Market Trends and Drivers:

The United States Gas Turbine Market is navigating a transformative period shaped by the rapid energy transition, where decarbonization goals and grid reliability demands often collide. The Inflation Reduction Act’s $370 billion in clean energy incentives has diverted investment toward renewables, leading to a 22% decline in gas turbine orders for traditional power plants since 2021. Nevertheless, the retirement of nuclear and coal-fired plants has created a capacity void, driving utilities to deploy advanced H-class turbines—with up to 64% efficiency—as flexible backup during renewable intermittency.

This dual mandate is reflected in strategic shifts by major players such as GE Vernova and Siemens Energy, with 47% of new turbine sales now supporting hydrogen blending (up to 50% volume). Moreover, the adoption of digital twins for predictive maintenance surged by 300% in 2023, highlighting a shift toward lifecycle optimization. As the EPA’s Clean Power Plan 2.0 proposes tighter NOx limits (0.15 lb/MWh) by 2025, combined-cycle plants are eyeing carbon capture retrofits. Despite policy headwinds, extreme climate events—such as the 2023 Midwest heatwave—reinforced gas turbines' critical role in ensuring grid resilience, anchoring their position in the evolving United States Gas Turbine Market Size landscape.

Trade dynamics and geopolitical disruptions are redefining manufacturing strategies across the United States Gas Turbine Market. With import tariffs on Chinese turbine castings reaching 35% and rare earth supply shocks stemming from the Russia–Ukraine conflict, domestic production has gained momentum. GE’s $100 million Alabama facility now produces 70% of hot-section components in the U.S., slashing lead times by 50%. Simultaneously, the defense sector plays an increasingly strategic role, with Pratt & Whitney landing $2.4 billion in Pentagon contracts for turbine-powered naval systems. The CHIPS Act is indirectly fueling turbine innovation, enabling localized FADEC (Full Authority Digital Engine Control) system production by Eaton and Woodward.

However, skilled labor shortages persist—52% of turbine manufacturers report critical welding technician gaps—prompting partnerships like Mitsubishi Power’s Texas-based workforce development center. These structural shifts are bolstering U.S. competitiveness, reshaping the United States Gas Turbine Market Share in favor of vertically integrated manufacturers while pressuring smaller, niche players. The rise of decentralized energy systems is another key driver of growth in the United States Gas Turbine Market. Small-scale turbines under 100MW are seeing increased deployment across industrial campuses. Corporations such as Dow are investing in on-site aeroderivative turbines to reduce grid dependency, achieving 92% uptime compared to the 78% average for centralized supply.

The hydrogen economy is also gaining momentum—63 green hydrogen projects launched in 2023 require turbine-driven electrolyzers, with Caterpillar’s 10MW systems capturing 40% United States Gas Turbine Market Share in this segment. Data centers are another growth frontier, with Microsoft’s Azure campuses utilizing 25MW turbines to meet 300% compute demand growth since 2021. FERC Order 2222 and IEEE 2030.5 cybersecurity standards are enhancing regulatory confidence in distributed assets. This fragmentation has actually strengthened OEM service models, as predictive maintenance contracts now account for 58% of Siemens Energy’s regional profits—up from 32% just four years ago.

Technology, policy, and market consolidation are converging to define the future trajectory of the United States Gas Turbine Market. Efficiency and flexibility are paramount—Ansaldo Energia’s GT36 now achieves cold starts in just 20 minutes, while Mitsubishi’s JAC turbines support 35% hydrogen blends without retrofitting. As ERCOT anticipates 42GW of new renewable capacity by 2026, the ability to provide rapid backup is becoming non-negotiable. The market is also consolidating rapidly: GE Vernova’s acquisition of Baker Hughes' turbine division in 2023 gave it control of 61% of the heavy-duty segment, while KKR’s purchase of Opra Turbines secured dominance in the 5–15MW range.

Despite this, fragmentation remains significant in the turbine digitalization space, where over 75 engineering firms compete for software and integration contracts. Policy remains a pivotal force—DOE’s 2024 Advanced Turbine Program allocated $45 million toward superalloy R&D to push efficiency past 70%. Meanwhile, the Supreme Court’s Ohio v. EPA ruling paused emissions enforcement, sparking a 17% Q3 surge in turbine orders as utilities raced to secure installations ahead of regulatory tightening.

As 2024 progresses, the United States Gas Turbine Market Size continues to expand, despite lingering transformer shortages that delayed 23% of installations. The path forward is defined by three strategic paradoxes: decarbonization versus grid stability, global sourcing versus domestic resilience, and industry consolidation versus technological disruption. Successfully navigating these competing forces will be key to maintaining and growing United States Gas Turbine Market Share in an increasingly complex and climate-stressed energy ecosystem.

United States Gas Turbine Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Technology:

Combined Cycle Gas Turbine

Open Cycle Gas Turbine

Breakup by Design Type:

Heavy Duty (Frame) Type

Aeroderivative Type

Breakup by Rated Capacity:

Above 300 MW

120-300 MW

40-120 MW

Less Than 40 MW

Breakup by End User:

Power Generation

Mobility

Oil and Gas

Others

Breakup by Region:

Northeast

Midwest

South

West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Write a comment ...