Market Overview 2025-2033

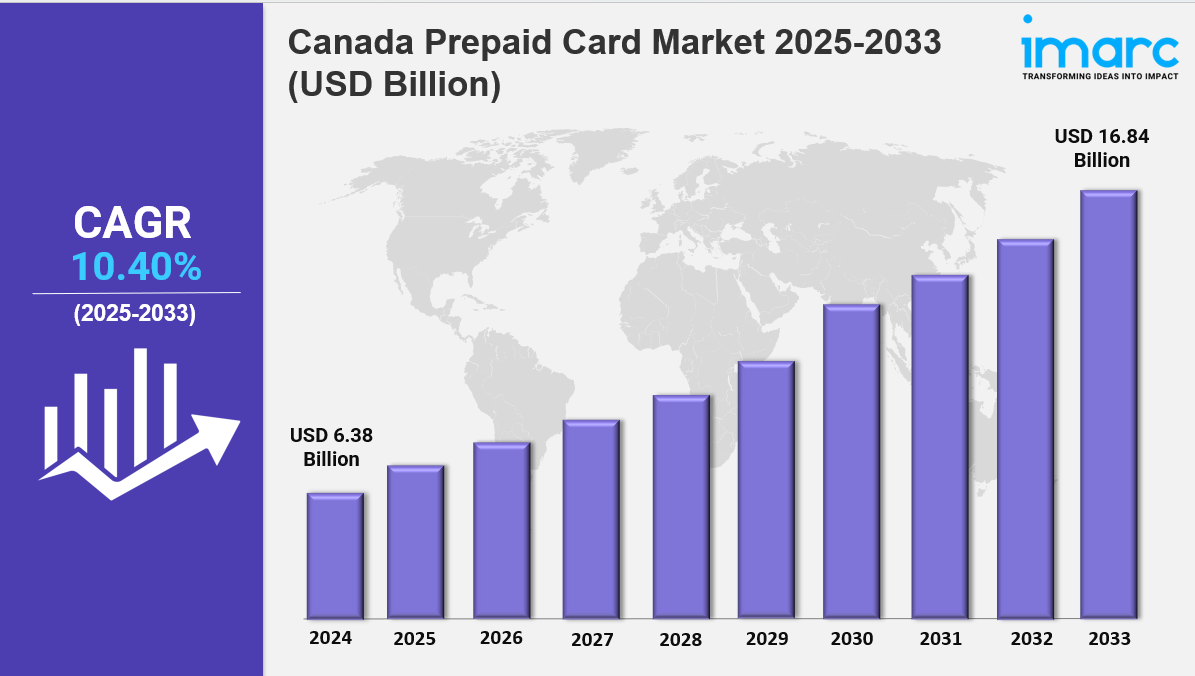

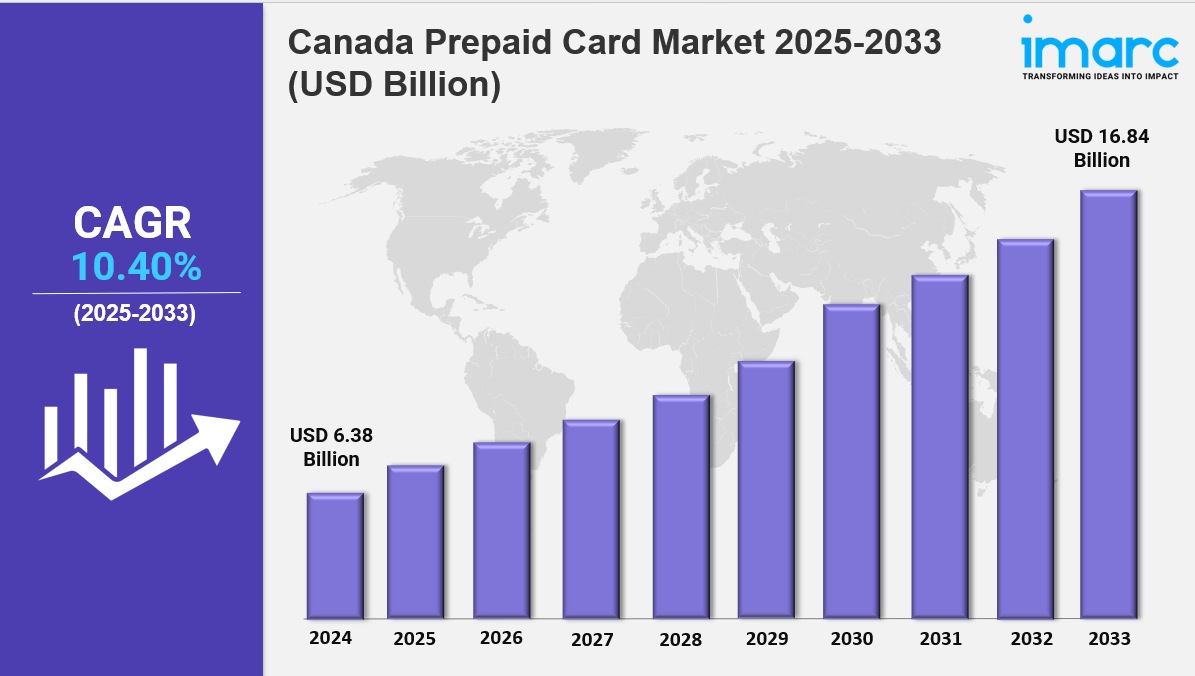

The Canada prepaid card market size reached USD 6.38 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.84 Billion by 2033, exhibiting a growth rate (CAGR) of 10.40% during 2025-2033. The market is undergoing significant expansion, fueled by the rising popularity of cashless transactions, increased consumer convenience, and the growing adoption of digital payment solutions.

Key Market Highlights:

✔️ Significant growth driven by the increasing shift towards cashless payment methods

✔️ Rising popularity of reloadable and gift prepaid cards among consumers

✔️ Enhanced focus on security features and integration with loyalty programs

Request for a sample copy of the report: https://www.imarcgroup.com/canada-prepaid-card-market/requestsample

Canada Prepaid Card Market Trends and Drivers:

The Canada Prepaid Card Market is seeing steady expansion as consumers increasingly seek flexible and controlled payment solutions. With a noticeable shift away from traditional cash and credit card usage, prepaid cards have emerged as a preferred financial tool—especially among younger Canadians. These cards offer a practical alternative for managing everyday expenses such as groceries, utility bills, and e-commerce purchases without the risk of accumulating debt.

What was once considered a limited-use financial product has entered the mainstream. Financial institutions, fintech platforms, and retailers are broadening their offerings to meet growing Canada Prepaid Card Market Demand. Recent Canada Prepaid Card Market Trends point to increased adoption of reloadable cards, particularly among students, freelancers, and consumers focused on budgeting. The ability to load a set amount and track spending encourages responsible money management, contributing to the market's appeal.

Technology is another driving factor in this growth. Most prepaid card providers now offer mobile applications that support real-time balance checks, transaction monitoring, and seamless reloading. These digital tools enhance user experience and accessibility across demographics—from first-time earners to retirees managing fixed incomes.

The product landscape is also diversifying. Travel cards, digital gift cards, and prepaid solutions for business expenses are now widely available. Companies are increasingly leveraging prepaid cards for employee bonuses, corporate incentives, and customer loyalty programs, further contributing to the Canada Prepaid Card Market Growth.

Looking ahead, the Canada Prepaid Card Market Outlook remains positive. As consumer awareness continues to grow and digital infrastructure improves, prepaid cards are becoming a regular part of household financial strategies. They are no longer seen as secondary tools but as integral components of how Canadians manage, allocate, and control their spending.

Canada Prepaid Card Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Card Type:

Closed Loop Cards

Open Loop Cards

Breakup by Purpose:

Payroll/Incentive Cards

Travel Cards

General Purpose Reloadable (GPR) Cards

Remittance Cards

Others

Breakup by Vertical:

Corporate/Organization

Retail

Government

Others

Breakup by Region:

Ontario

Quebec

Alberta

British Columbia

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302

Write a comment ...