Market Overview 2025-2033

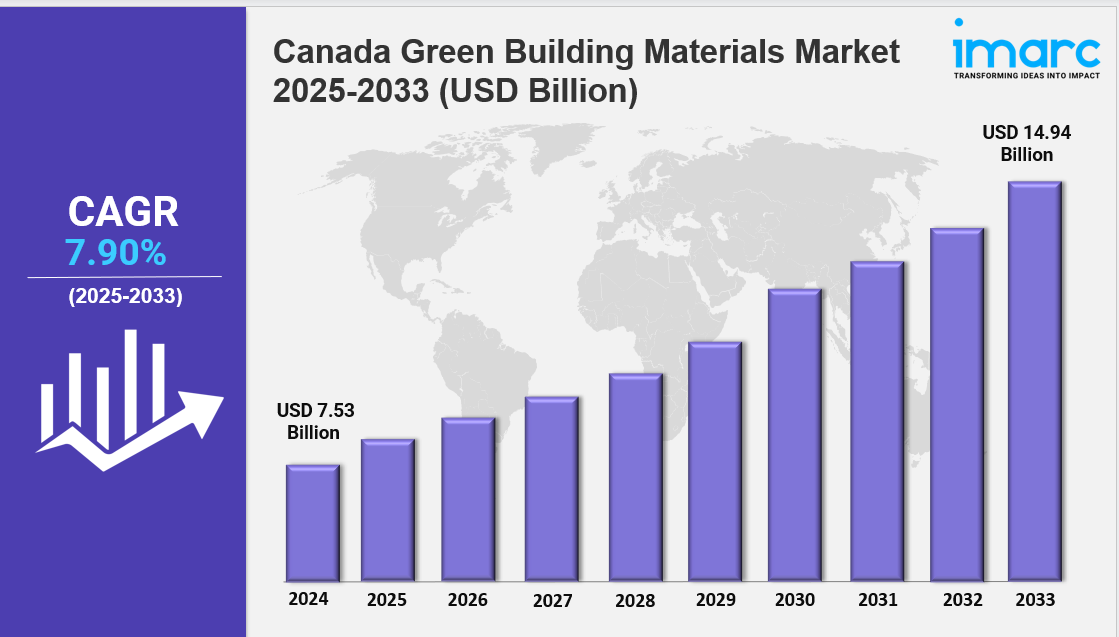

The Canada green building materials market size reached USD 7.53 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.94 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The market is expanding due to rising green building regulations, increasing demand for sustainable materials, and government incentives. Growth is driven by innovations in recycled plastics, mass timber, and energy-efficient solutions, making the industry more eco-conscious, resilient, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising focus on energy efficiency and sustainable construction practices

✔️ Increasing demand for eco-friendly materials like recycled steel, low-VOC paints, and insulated panels

✔️ Expanding government initiatives and green certification programs promoting environmentally responsible building solutions

Request for a sample copy of the report: https://www.imarcgroup.com/canada-green-building-materials-market/requestsample

Canada Green Building Materials Market Trends and Drivers:

The Canada Green Building Materials Market is seeing remarkable growth, driven largely by stricter environmental regulations and a growing demand for sustainable construction. New rules like the Net-Zero Emissions Accountability Act and updated National Building Codes are pushing builders and developers to adopt low-carbon materials as the new standard. With carbon pricing set to reach C$170 per ton by 2030 and provincial policies like British Columbia’s Zero Carbon Step Code in place, green building is no longer optional—it’s expected. This shift has led to a 78% increase in the use of eco-friendly materials like mass timber, low-carbon concrete, and high-efficiency insulation since 2022.

Leading Canadian manufacturers such as Nexii Building Solutions and Structurlam have expanded their operations by more than 200% to keep up with demand. In Ontario and Quebec, new Tiered Energy Standards have sparked a surge in energy-efficient retrofits, with commercial building upgrades growing at an annual rate of 14%. However, as more builders look to meet green standards, supply chains are feeling the pressure. In 2024, materials like hempcrete and mycelium-based composites carried a 22% premium due to limited local production and high demand.

At the same time, circular building practices are becoming more mainstream. In major cities, construction waste recycling rates now top 65%, thanks to advanced recovery facilities that process over 3 million tonnes of demolition material annually. These facilities are helping feed recycled steel and gypsum back into the construction pipeline—cutting emissions and keeping costs down. Platforms developed by companies like Gensuite and Circular Materials Canada now allow builders to track materials from origin to reuse, helping projects meet stricter green certifications. In fact, in 2024, 42% of LEED-certified buildings also achieved TRUE Zero Waste status, up from just 18% two years earlier.

There’s also been a major rise in demand for prefabricated and modular components designed for easy disassembly and reuse. Reclaimed timber sales exceeded C$800 million in 2024 alone. But challenges remain. Recycling infrastructure varies from region to region, and processing newer composite materials is still more expensive than traditional methods.

A standout development in the Canada Green Building Materials Market is the role of Indigenous-led initiatives. These partnerships have helped reshape the sector, with First Nations-owned businesses accounting for 19% of sustainable material supply in 2024. Projects like the Heiltsuk Big House and Cree-led timber facilities are not only using local materials, but also generating significant local economic benefits. New federal procurement guidelines now require materials for public buildings to come from within 50 kilometers, further increasing demand for regionally sourced resources like Atlantic seaweed insulation and flax-based composites from the Prairies. Meanwhile, the Indigenous Clean Energy Accelerator awarded over C$120 million in grants to scale traditional, eco-friendly building practices—like carbon-sequestering clay plasters.

Three key trends are shaping Canada Green Building Materials Market Growth: the urgent push to decarbonize, the adoption of digital material tracking, and a stronger focus on climate-resilient construction. Carbon-cured concrete alone saw a 28% rise in adoption in 2024. Blockchain-based Environmental Product Declarations (EPDs) have grown by 300%, allowing builders to better track the environmental impact of every product used. Meanwhile, the demand for materials that can withstand extreme weather—like flood-resistant bio-cement—has jumped by 67% following Canada’s recent wildfire seasons.

Tariffs on imported European low-carbon steel also redirected procurement toward domestic suppliers, shortening delivery times and boosting local production. New performance-based building codes—now adopted by 73% of provinces—are encouraging more innovation, including biomimetic materials like self-healing concrete. Still, one of the biggest challenges facing the market is a shortage of skilled labor for installing these advanced materials. Even with a national upskilling initiative worth C$1.2 billion launched in 2024, the gap persists.

As competition increases, consolidation is reshaping the landscape. Fourteen major mergers and acquisitions took place last year, strengthening the position of key players such as EllisDon Circular. With demand showing no signs of slowing, the Canada Green Building Materials Market Share is expected to rise sharply in the coming years—anchored by sustainability, innovation, and a commitment to low-carbon construction.

Canada Green Building Materials Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Application:

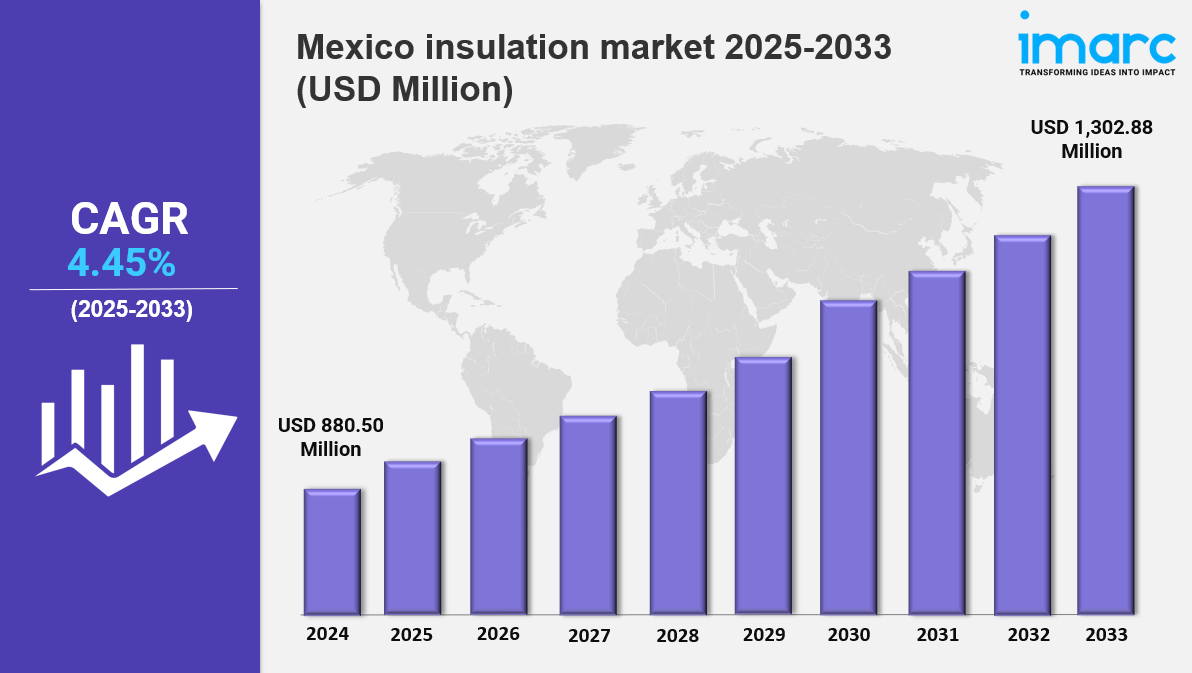

Insulation

Roofing

Framing

Interior Finishing

Exterior Siding

Others

Breakup by Region:

Ontario

Quebec

Alberta

British Columbia

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Write a comment ...